Crafting a Financial Strategy With Bookkeeping 8142564839

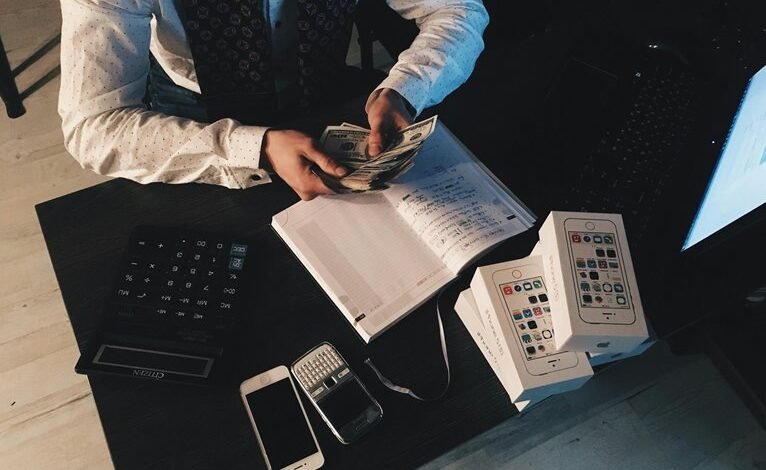

Crafting a financial strategy with bookkeeping is a critical component of sustainable business growth. Effective bookkeeping practices provide clarity on cash flow and expenses, enabling organizations to align their financial decisions with long-term objectives. The integration of technology further enhances these processes, offering timely insights. However, understanding how to analyze financial data strategically can reveal hidden opportunities and potential pitfalls. What specific strategies can businesses implement to optimize their financial management practices?

Understanding the Importance of Bookkeeping in Financial Strategy

Although often overlooked, bookkeeping serves as the foundational element of any effective financial strategy.

It ensures financial accuracy by meticulously tracking transactions, which safeguards against discrepancies. This precision fosters an understanding of cash flow, enabling individuals to make informed decisions about expenditures and investments.

Ultimately, a robust bookkeeping system empowers one to achieve financial independence, paving the way for strategic growth and sustainability.

Key Bookkeeping Practices for Effective Financial Management

Effective financial management hinges on the implementation of key bookkeeping practices that provide clarity and control over an organization’s financial landscape.

Central to this approach is meticulous cash flow monitoring, which allows for timely decision-making.

Additionally, robust financial forecasting enables businesses to anticipate future challenges and opportunities, thus ensuring strategic allocation of resources and fostering an environment where financial freedom can thrive.

Leveraging Technology for Streamlined Bookkeeping

As businesses increasingly embrace digital transformation, leveraging technology for streamlined bookkeeping has become essential for enhancing financial efficiency.

Cloud solutions enable real-time access to financial data, while automated processes reduce manual errors and save time.

Analyzing Financial Data to Inform Strategic Decisions

While many businesses focus on operational efficiency, the importance of analyzing financial data to inform strategic decisions cannot be overstated.

Effective financial forecasting, supported by robust data visualization techniques, enables companies to identify trends, assess risks, and allocate resources judiciously.

Conclusion

In conclusion, effective bookkeeping is integral to crafting a robust financial strategy, as it not only ensures accurate tracking of transactions but also enhances strategic decision-making. Notably, businesses that implement disciplined bookkeeping practices can improve their cash flow management by up to 30%, highlighting the tangible benefits of meticulous financial oversight. By leveraging technology and analyzing financial data, organizations can navigate challenges more adeptly and position themselves for sustainable growth and financial independence.