Key Concepts in Bookkeeping рунпут

Key concepts in bookkeeping establish the framework for sound financial management. Accurate record-keeping is crucial for tracking financial transactions and ensuring transparency. Familiarity with financial statements and essential bookkeeping terminology enhances decision-making capabilities. Implementing best practices further reinforces data integrity. These elements collectively shape a comprehensive understanding of financial operations. However, the nuances of each aspect warrant closer examination to fully grasp their implications in real-world scenarios.

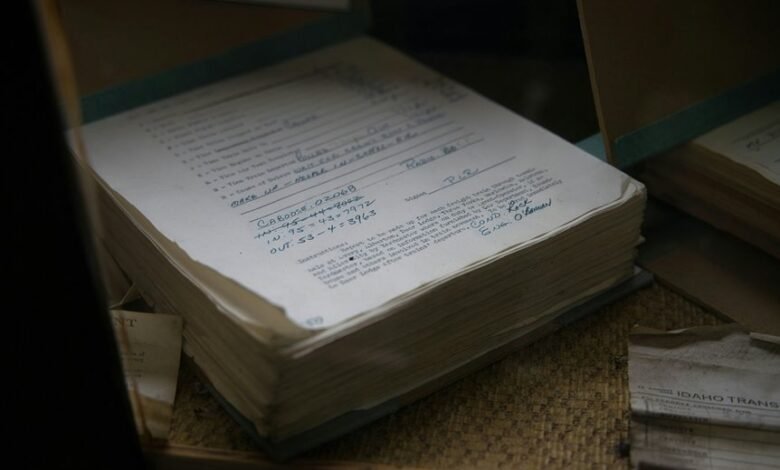

The Importance of Accurate Record-Keeping

Accurate record-keeping serves as the foundation of effective bookkeeping and financial management. The importance of accuracy cannot be overstated; it ensures reliable data for decision-making and compliance.

Record-keeping benefits extend beyond mere documentation, fostering transparency and accountability. By maintaining precise records, individuals and organizations can navigate financial landscapes with confidence, ultimately achieving greater autonomy and informed financial independence.

Understanding Financial Statements

Financial statements serve as a critical tool in the realm of bookkeeping, providing a structured overview of an entity’s financial performance and position.

Through statement analysis, stakeholders can evaluate financial health using financial ratios, which offer insights into profitability, liquidity, and solvency.

Understanding these statements enables informed decision-making, fostering a sense of autonomy and clarity in financial management and strategic planning.

Key Bookkeeping Terms and Definitions

A comprehensive understanding of key bookkeeping terms and definitions is essential for anyone engaged in financial management.

Familiarity with debit definitions and credit terminology is crucial, as these concepts form the foundation of accurate financial reporting.

Mastery of these terms enables professionals to effectively track financial transactions, ensuring clarity in accounts and supporting informed decision-making in various business contexts.

Best Practices for Effective Bookkeeping

Effective bookkeeping is essential for maintaining the integrity of an organization’s financial records.

Implementing best practices such as efficient invoicing and meticulous expense tracking can significantly enhance accuracy.

Regular reconciliations and timely updates contribute to reliable data management, fostering informed decision-making.

Conclusion

In the realm of bookkeeping, accuracy and diligence stand as twin pillars supporting financial stability. While meticulous record-keeping illuminates the path to informed decision-making, the absence of such practices casts shadows of uncertainty and risk. The interplay of financial statements and essential terminology creates a tapestry of understanding, guiding businesses toward strategic growth. Ultimately, adhering to best practices not only fosters transparency but also cultivates a culture of accountability, ensuring that financial operations thrive amidst an ever-evolving landscape.